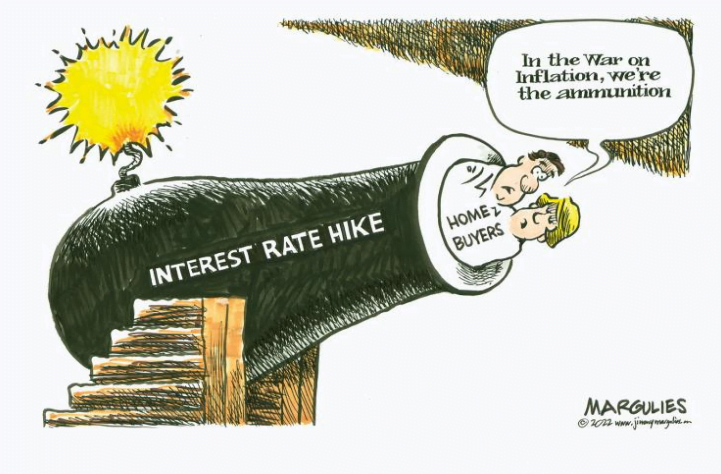

The most recent inflation figures, both here and in the US, reinforce that inflation is here to stay, with US inflation having risen to 3.7% in August 2023 (up from 3.2% in July 2023), and Australian inflation remaining elevated at a rate of 5.2% in June 2023. At the same time, expectations of higher oil prices have been adding to inflationary pressures and dashed hopes that interest rates will be cut in early 2024. A structurally elevated cash rate is seen as a reality and has opened the door to further interest rate hikes.

The End of Free Money